- Update your IT operating model to get ready for the ‘new normal’

By 2020, your operating model is probably going to look quite stale, even if it is serving you well today. That is because what your financial institution offers to your customers is almost certain to change, in ways both large and small. This will require important changes across, and around, the entire IT stack.

The overriding principle is that financial institutions and their IT organizations must be prepared for a world where change is constant—and where digital comes first. For this to happen, it is time to really put legacy assumptions on the table. It may appear logical to continue to support core mainframe systems, given the potential disruption and perceived cost of transition to something different. But if the existing platform could be replicated at half the cost, would the logic still apply? Or at one tenth the cost?

- Slash costs by simplifying legacy systems, taking SaaS beyond the cloud, and adopting robotics/AI

One of the starkest differences between a legacy financial services institution and a FinTech upstart comes down to fixed assets. Incumbents carry a huge burden of IT operating costs, stemming from layer upon layer of systems and code. They have bolted on a range of one-time regulatory fixes, fraud prevention, and cyber-security efforts, too. The ever-spreading cost base leaves less budget available for capital investment into new technology, driving a vicious cycle of increased operating costs. This is in clear contrast to the would-be disruptors, who typically have far lower operating costs, only buying what they need when they need it.

It doesn’t have to be that way. In fact, from our experience working with a wide variety of clients in banking and capital markets, insurance, and asset management, we think many financial institutions are spending up to twice as much as they need to on IT.

- Build the technology capabilities to get more intelligent about your customers’ needs

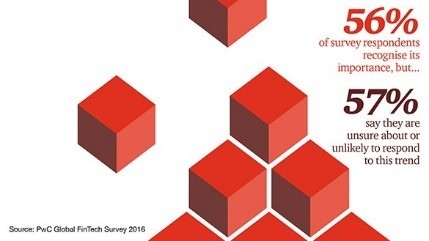

Customer intelligence—and the ability to act in real-time on that intelligence—is one of the key trends affecting the financial services industry, and it will drive revenue and profitability more directly in the future. As this happens, many of the attributes that drive today’s brands, from design to delivery, could become less important. By 2020, we expect that the ‘new normal’ operating model will be customer- and context-cantered. That is, companies will change the way they interact with their customers based on the context of the exchange. They will offer a seamless omnichannel experience, through a smart balance of human and machines.

- Prepare your architecture to connect to anything, anywhere

Here are just a few of the endpoints that will need to coexist and cooperate:

- Enterprise databases, data warehouses, applications, and legacy systems

- Cloud services

- Business-to-Business (B2B) connections, linking to comparable systems at partners and suppliers

- Business-to-Consumer (B2C) connections, linking to apps, wearables and mobile devices at an individual user level

- Bring-Your-Own-Device (BYOD) connections, using an enterprise mobility strategy to link to employees and contractors

- Third party ‘big data’ sources

- IoT sensors

The systems are diverse, and they are getting more complex by the week. Now, financial institutions will need to layer on a more sophisticated view of federated identity management, because companies will be dealing with new classes of users. Systems architecture can be the key to balancing control and accessibility. That is, the way you assemble the technical building blocks can protect your institution against cyber-threats without adding needless barriers to discourage interaction.

- You can’t pay enough attention to cyber-security

Financial institutions have been addressing information security and technology risks for decades. But a growing number of cybersecurity “events” in recent years has shown that the traditional approach is no longer good enough. In fact, in PwC’s Global State of Information Security Survey 2016, we found that there were 38% more security incidents detected in 2015 than the year before. Many financial institutions still rely on the same information security model that they have used for years: one that is controls- and compliance-based, perimeter-oriented, and aimed at securing data and the back office. But information security risks have evolved dramatically over the past few decades, and the approach that financial institutions use to manage them has not kept pace.

- Make sure you have access to the necessary talent and skills to execute and win

As financial institutions look to the future, one of the biggest hurdles will have nothing at all to do with technology. For years, traditional financial institutions have designed their offerings from the inside out: “this is what we will offer,” rather than “what do our customers want?” But this model no longer works. And the skills and interests of today’s IT team members and third-party talent may not be up to the challenges of tomorrow’s technical environment, where partnering with customers will be essential.